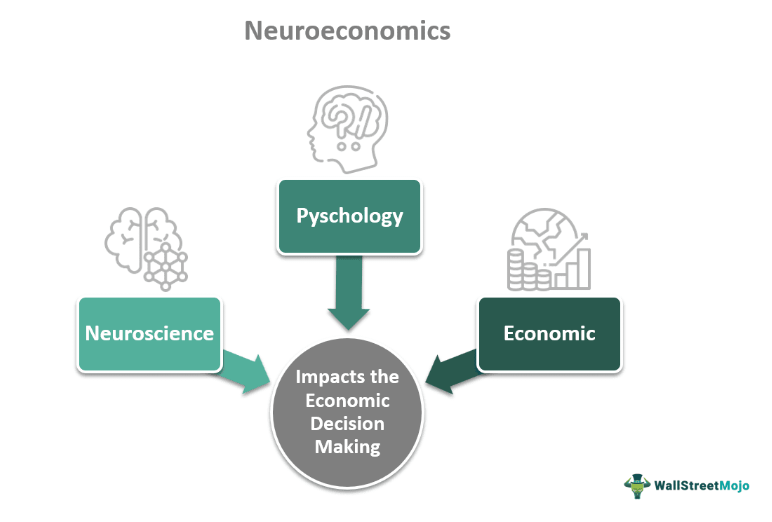

In our day-to-day lives, financial decisions shape our present and future well-being. From investing in stocks to saving for retirement, these choices are not purely rational but are influenced by a myriad of subconscious factors. Enter neuroeconomics, a fascinating field that explores the neural mechanisms underlying economic decision-making. In this article, we’ll explore how neuroeconomics impacts the everyday lives of individuals, with a focus on investments and savings, and provide practical examples to illustrate its influence.

1. Understanding Risk Perception:

Neuroeconomics sheds light on how our brains perceive and respond to risk, a fundamental aspect of investment decision-making. For example, individuals may be more risk-averse when faced with potential losses compared to potential gains, a phenomenon known as loss aversion. This innate aversion to losses can influence investment behavior, causing individuals to prioritize the preservation of wealth over maximizing returns. By understanding the neural mechanisms driving risk perception, individuals can make more informed decisions about asset allocation, diversification, and risk management in their investment portfolios.

Example: Consider an investor who is hesitant to invest in stocks due to fear of market volatility and potential losses. By recognizing that this fear is driven by neural processes associated with loss aversion, the investor can take steps to mitigate risk through diversification, investing in a mix of assets such as stocks, bonds, and real estate to spread risk and achieve long-term financial goals.

2. Overcoming Behavioral Biases:

Neuroeconomics highlights the role of behavioral biases in shaping investment and savings behavior. From overconfidence and anchoring to herd mentality and recency bias, these biases can lead individuals to make irrational decisions that deviate from their long-term financial goals. By understanding the underlying neural mechanisms of these biases, individuals can develop strategies to counteract their influence and make more rational investment and savings choices.

Example: Imagine an individual who frequently checks their investment portfolio and is prone to making impulsive decisions based on short-term market fluctuations. By recognizing that this behavior is driven by neural processes associated with recency bias and overreaction to new information, the individual can adopt a disciplined approach to investing, such as setting predefined investment goals and sticking to a long-term investment strategy regardless of short-term market volatility.

3. Automating Savings:

Neuroeconomics suggests that our brains are wired to prefer immediate rewards over delayed gratification, making it challenging to save for the future. However, by leveraging insights from behavioral economics and neuroscience, individuals can overcome this bias and cultivate a habit of saving. Automated savings mechanisms, such as setting up regular transfers from checking to savings accounts or enrolling in employer-sponsored retirement plans, capitalize on our brain’s tendency to default to familiar and convenient options, making it easier to save consistently over time.

Example: Consider an individual who struggles to save money due to competing demands on their income. By automating savings through payroll deductions or setting up automatic transfers to a designated savings account, the individual can overcome inertia and effortlessly build a financial cushion for emergencies or long-term goals like retirement.

Conclusion:

Neuroeconomics offers valuable insights into the psychological and neural processes that influence investment and savings behavior in everyday life. By understanding how our brains perceive risk, navigate behavioral biases, and respond to incentives, individuals can make more informed decisions to secure their financial futures. Whether it’s managing investment portfolios, overcoming behavioral biases, or automating savings, harnessing the power of neuroeconomics can transform the way we approach investments and savings, leading to greater financial security and well-being in the long run. Do share your inputs and comments.